Retirement Planning

Retirement planning for small business owners is about more than just saving—it involves choosing the right retirement solutions to secure financial independence and bolster employee loyalty, while ensuring that your future goals align with your business journey.

Why Retirement Planning Matters

Retirement planning helps small business owners:

- Pursue long-term financial security through tax-advantaged savings accounts.

- Reduce current tax liability via deductible contributions and potential tax credits, such as credits for starting a plan and the Saver’s Credit for lower-income employees.

- Attract and retain talent, offering competitive benefits that foster loyalty and satisfaction among employees.

Popular Retirement Plan Options

Several well-established plans cater to different needs and business sizes:

- SEP IRA: Simplified Employee Pension IRAs, easy to set up, suited for owner-only businesses or those with employees, with contributions from the employer only.

- SIMPLE IRA: Ideal for businesses with up to 100 employees, funded via employee salary deferrals and matched employer contributions.

- Solo 401(k): Designed for owner-only businesses, offers high contribution limits and flexibility; both employer and employee contributions are allowed.

- Traditional 401(k): Suitable for businesses of any size, allows high employee and employer contributions, customizable plans but involves more administration.

- Defined Benefit Plan: Highest contribution limits, best for those aiming for a specific income in retirement, typically suited for small firms (up to five employees).

Strategic Retirement Planning Tips

- AdvisersTrust Wealth Management evaluates both personal and professional goals to ensure that your plan aligns with your intended retirement lifestyle and your business succession needs.

- Balance administrative capacity, cost, and contribution flexibility; simpler plans like SEP and SIMPLE IRAs offer lower costs and ease of management, while 401(k) plans provide higher limits and custom features at the expense of added complexity.

- By choosing to work with AdvisersTrust Wealth Management, we’ll provide tailored advice that may simplify complex scenarios such as exit or succession planning.

- Finally, boost engagement and morale by giving employees a clear path to long-term financial security while providing business owners with the same tax and savings advantages, ensuring their own retirement readiness

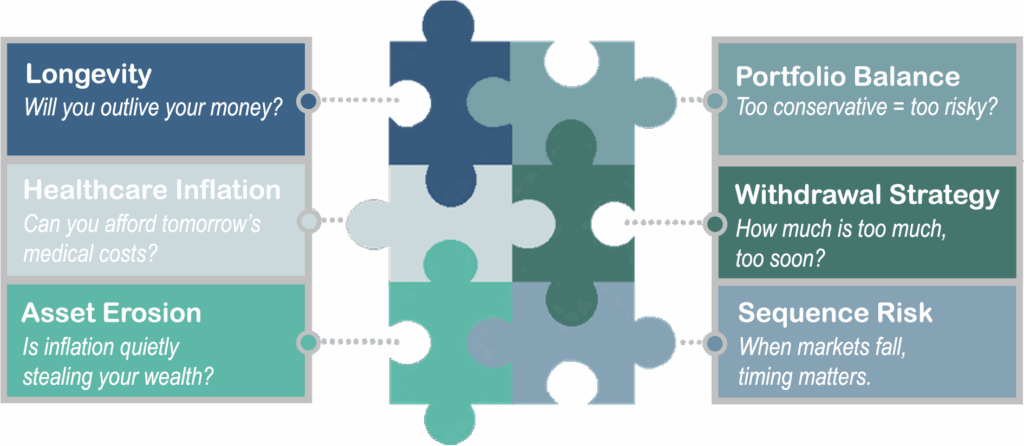

The Retirement Puzzle: Six Pieces That Could Determine Your Future

Where will you be financially in 10, 20, 30 years? Most people can’t answer this question with confidence. That’s the puzzle we’ll attempt to solve with you. Build your strategy around ‘comfortable’ and your future may not be…