Investment Management /

Advisory

Discover the Experience Existing AdvisersTrust Clients Have Trusted for Decades.

At AdvisersTrust, we’ve been guiding clients toward financial security for several decades, building lasting relationships based on trust, expertise, and results. Our investment management services are designed to align with your unique goals—whether you’re planning for retirement, growing your portfolio, or preserving wealth for future generations. With a client-centered approach, we combine time-tested strategies, personalized advice, and cutting-edge tools to help you navigate market complexities with confidence.

Join many clients who have experienced the difference. Let’s explore how we can elevate your financial journey.

-

Personalized Portfolios with Fiduciary Duty

-

Active Management with Tax Efficient Strategies

-

Alternative Investments

We’ll make your WEALTH work for YOU

At AdvisersTrust Wealth Management, we believe in forging lasting partnerships built on trust, accountability, and a shared vision for financial prosperity. Our professional experience, combined with our decades’ long market knowledge, is the advantage you’ll need to help meet the challenges ahead.

The big money is not in the buy & sell, it’s in the waiting.

- Charley Munger 1/1/1924-11/28/2023

Building long-term Meaningful Wealth

At the CORE of every portfolio is its FOUNDATION. Our client FOUNDATIONS are built balancing risk / return characteristics (unique to their owners), and are constructed of individual components that have successfully weathered the test of time. Modern Portfolio Theory, the Nobel Prize winning theory, is the belief that an expected portfolio return can be achieved for a given amount of portfolio risk. In theory, investment diversification provides a lower risk than any one component. Our client foundations, their portfolio cores, are structured in such a manner.

What is Strategic Investing?

“Strategic Investing” is Direct Ownership

“Strategic Investing” is Direct Ownership in individual stocks, individual bonds and money market instruments providing transparency and control over what you actually own.

“Strategic Investing” in Forwarding Looking Assets

“Strategic Investing” is investing in Forwarding Looking Assets, providing investors with access to innovative investment opportunities, including alternative strategies designed for an evolving financial landscape.

“Strategic Investing” integrates passive and active strategies

“Strategic Investing” integrates the best elements of active and passive investment strategies, leveraging market insights to optimize growth while minimizing risk.

“Strategic Investing” is Cost-Conscious Investing

“Strategic Investing” is Cost-Conscious Investing – All-In expense ratios that could save you 1/8%, 1/4%, 1/2% or more annually.

“Strategic Investing” is Tax Smart Investing

“Strategic Investing” is Tax Smart Investing with low annual portfolio turnover rates combined with annual tax-loss harvesting in anticipation of “better” after-tax results, year after year.

“Strategic Investing” is partnering with Walter Pachniuk, CFP® professional and AdvisersTrust Wealth Management

“Strategic Investing” means partnering with the founder of AdvisersTrust Wealth Management, an investment professional that prioritizes your success over any fee or any commission driven motive. This distinction is fundamental to our philosophy, ensuring that advice and guidance are always in your best interest, inspired by a commitment to your long-term financial success.

We Live These Values Daily

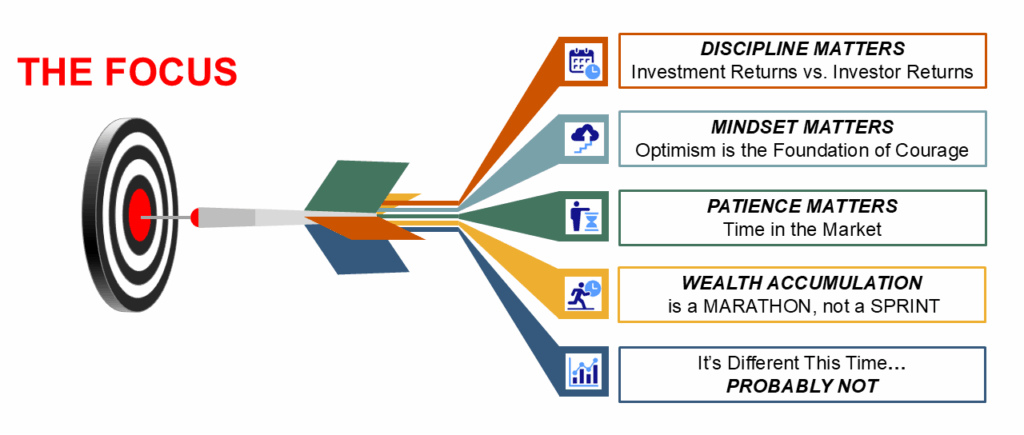

Five Core Wealth Building Principles

SCHWAB Held, AdvisersTrust Managed

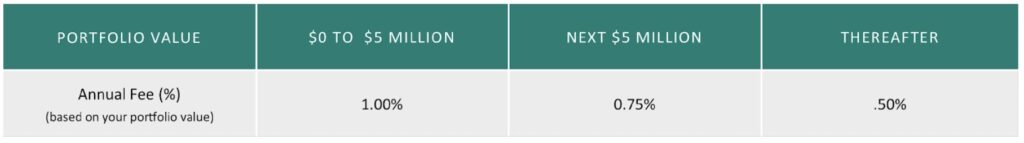

Fair and Flexible Fee Schedule

Simple. Transparent. Fair. Flexible.

We’ve intentionally structured our fees to put your long-term meaningful wealth first. By keeping costs low and fully transparent, we let the real magic happen — decades of uninterrupted compounding in a portfolio of stocks and bonds — the same proven engine Warren Buffet called the greatest wealth-building mechanism on earth.

The stock market is a device for transferring money from the impatient, to the patient.

- Warren Buffet